Buying a Home in Texas

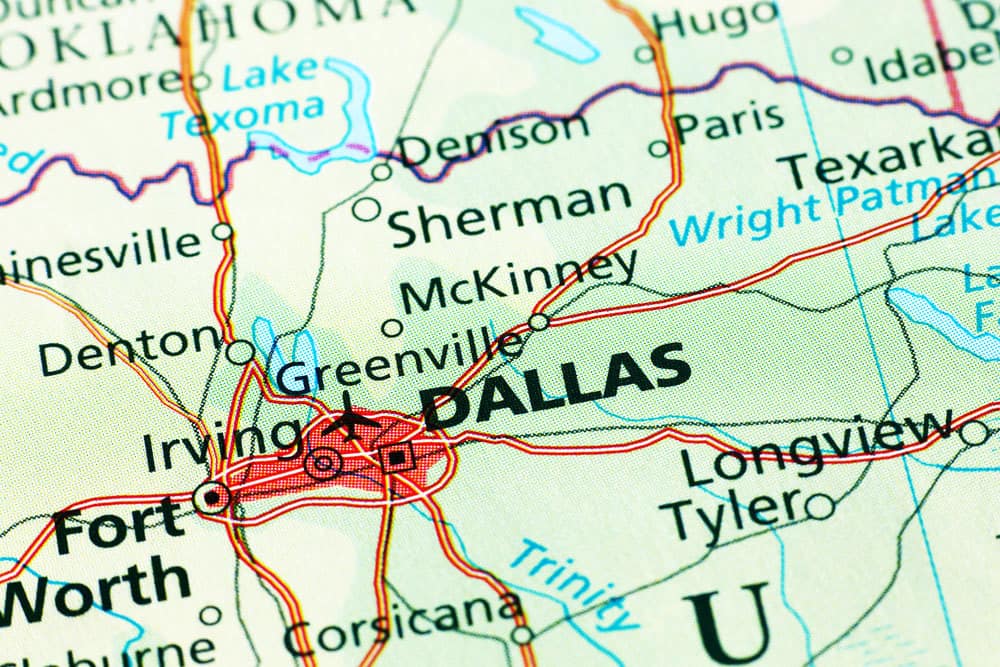

We specialize in properties on the East of 75 - From Firewheel to Fairview

Start your home search with us

Bishop Country can guide you through the process, answering your questions and serving as your advocate. One of our agents can help you find the property that fits your needs, submit offers and counteroffers, suggest a good property inspector and other professionals, and provide the kind of support and advice that can make your home-buying experience much less stressful.

Specific Questions a Buyer’s Agent Can Help Answer

Where Should I Live?

If you’re unfamiliar with the areas where you’re considering moving, your buyer’s agent is an invaluable resource. He or she can offer insider knowledge on neighborhoods, schools, recreation, shopping, and many other details about local neighborhoods and subdivisions.

What Features Do I Want in a Home?

It’s important to have a clear picture of what matters most to you in a home or location. Creating a list of “must haves” and flexible “nice-to-haves” at the beginning will make the process a lot easier. Your buyer’s agent can offer advice on the countless items you should consider according to your lifestyle, budget and particulars.

What Can I Expect During a Home Purchase?

Your real estate professional can familiarize you with everything you’ll encounter when you begin the home-buying process, including:

- Preapproval

- Submitting an offer

- Acceptance and sale agreement

- Placing a deposit (“earnest money”)

- Escrow

- Home inspection

- Applying for a mortgage

- Title history and property appraisal

- Closing

How Much House Can I Afford?

Knowing how much you can afford to pay is a crucial step in your search. Nailing down your budget early will make the overall process more focused and less stressful. A good way to figure out how much you can afford is to use the “28/36 Rule,” which states that no more than 28 percent of your gross monthly income should go toward housing costs (including mortgage principal, interest, taxes and insurance) and that your overall debt should not exceed 36 percent of your income.